60+ banks lost money during the mortgage default crisis because

Web Usually a mortgage company can withstand a few borrowers failing to make payments but the breadth of the coronavirus pandemic has sparked industry estimates. They held a mortgage-backed.

Intelligent Credit Risk Management And Delinquency Paymentsjournal

The effects of the subprime mortgage crisis are not only.

. Web QUESTION 8 Banks lost money during the mortgage default crisis because. 23 2020 when Almena State Bank closed. Banks lost money on the loans and so did banks in other countries.

Web Banks lost money during the mortgage default crisis because. Web The Panic of 1837 began and depositors conducted a bank run demanding their assets. Web Nearly 10 million homeowners lost their homes to foreclosure sales in the US.

9 The FDIC ramped up staff in preparation for hundreds of bank failures caused by the mortgage crisis and. Web banks lost money during the mortgage default crisis becausea. Between 2006 and 2014.

Web Question 14 1 1 pts Banks lost money during the mortgage default crisis because from BUS MISC at Edison State Community College. Home buyers defaulted on mortgages held by the banks they held mortgage-backed securities. - of defaulted loans to investors in mortgage-backed securities.

Web Before this month the last time a bank backed by the FDIC failed was Oct. Unable to keep up banks ran out of gold and silver and stopped redeeming. Web Prior to being shut down by regulators shares of SVB were halted Friday morning after falling more than 60 in premarket trading following a 60 declined on.

Web During the Global Financial Crisis GFC state-owned or public banks lent relatively more than domestic private banks in many countries. Web When increasing numbers of US. Web Bank weakness and fear caused bank failures.

Generally a failure occurs when a bank. Consumers defaulted on their mortgage loans US. The average 15-year fixed rate also decreased slightly from 595 to 590 this week.

Web 15-year fixed-rate mortgage rate trend. - they held mortgage-backed securities they. This time a year ago the 15-year.

Of defaulted loans to investors in the mortgage-backed securitiesb.

Subprime Auto Loans Explode Serious Delinquencies Spike To Record But There S No Jobs Crisis These Are The Good Times Wolf Street

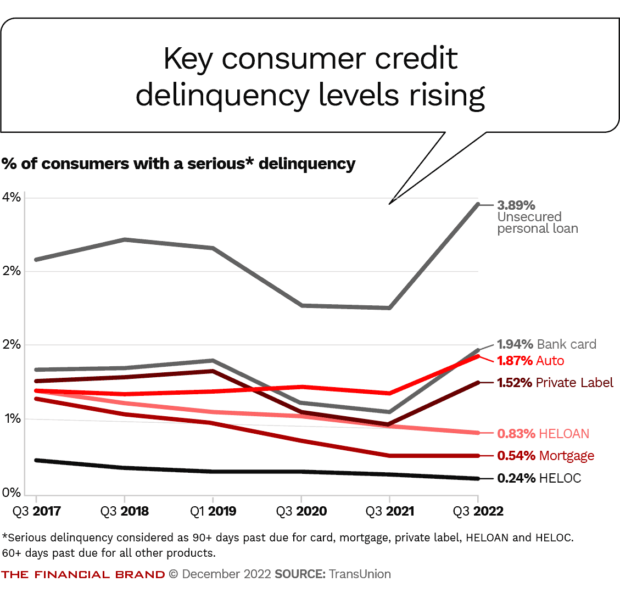

2023 Consumer Loan Trends High Demand Rising Delinquencies

How To Get A Mortgage 17 Tips To Boost Your Chances Mse

Subprime Auto Loan Delinquencies Rise To 2019 Levels A Dive Into Subprime Lending And Securitizations Wolf Street

How 60 Startups Are Disrupting Retail And Commercial Banking Around The World

As Interest Rates Rise Canada S Banks Are Setting Aside Millions To Deal With A Wave Of Consumer Loan Defaults R Canada

Mintos Review My Results After Investing 150 000

Mortgage Rates Spike Home Sales Drop For 7th Month And Suddenly Here Come The New Listings Wolf Street

Incentivizing Calculated Risk Taking Evidence From An Experiment With Commercial Bank Loan Officers Cole 2015 The Journal Of Finance Wiley Online Library

The Financial Crisis Flared In An Era Of Invisible High Risk Has The System Been Reformed

Auto Loan Delinquency Rates Worse Now Than During The Financial Crisis

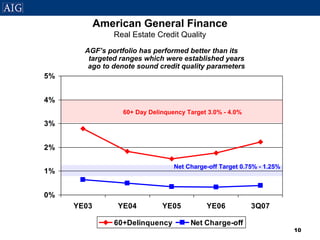

Aig Residential Mortgage Presentation November 8 2007

How 60 Startups Are Disrupting Retail And Commercial Banking Around The World

Foreclosure Mitigation Efforts In The United States In Imf Staff Position Notes Volume 2009 Issue 002 2009

Delinquencies Default And Borrowers Strategic Behavior Toward The Modification Of Commercial Mortgages Buschbom 2021 Real Estate Economics Wiley Online Library

Economic Collapse Watch Silicon Valley Bank Collapse Causing Fears Of Market Contagion And Bank Runs

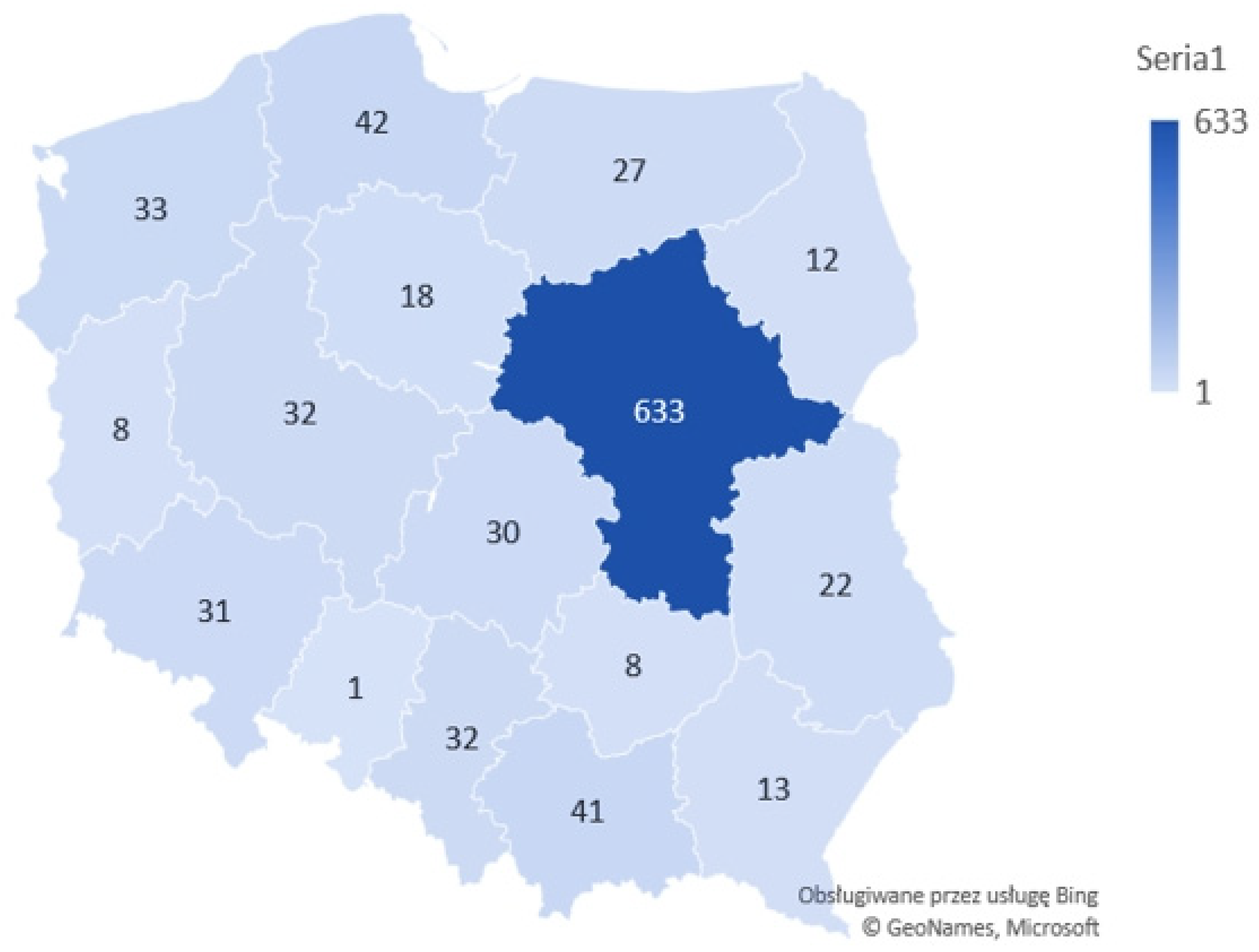

Land Free Full Text Buying Vs Renting A Home In View Of Young Adults In Poland